In the bustling intersection of science and industry, nanoemulsions stand as a revolutionary force, transforming how we deliver drugs, enhance cosmetics, and fortify foods. These ultrafine emulsions, with droplets typically ranging from 20 to 200 nanometers, offer superior stability, bioavailability, and targeted delivery compared to traditional emulsions. Born in laboratory beakers, their journey to commercial shelves is fraught with technical hurdles and stringent oversight. As the global nanoemulsion market surges—valued at approximately $12.5 billion in 2024 and projected to reach $23.6 billion by 2033 at a compound annual growth rate (CAGR) of 7.3%—understanding this transition is crucial. This blog delves into the intricacies of scaling up production while navigating regulatory landscapes, drawing on real-world facts and figures to illuminate the path from lab to market.

Unveiling the Nano World: What Are Nanoemulsions?

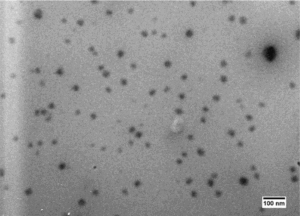

Nanoemulsions are colloidal dispersions where one immiscible liquid is finely dispersed in another, stabilized by surfactants. Unlike microemulsions, they require energy input for formation and are kinetically stable, resisting creaming or sedimentation for extended periods. Their small droplet size enhances optical clarity, increases surface area for better absorption, and allows encapsulation of hydrophobic actives like vitamins or anticancer drugs. In pharmaceuticals, they improve drug solubility by up to 1000-fold, enabling oral delivery of poorly water-soluble compounds. The food industry leverages them for nutrient fortification, with applications in beverages where they mask off-flavors without altering texture. Cosmetics benefit from their non-greasy feel, penetrating skin layers efficiently. Fact: Over 50% of new drug candidates are lipophilic, making nanoemulsions a game-changer in formulation science. Yet, their promise hinges on mastering production at scale.

Nano Emulsion Manufacturing: From Benchtop to Factory Floor

Nano emulsion manufacturing begins in the lab with high-energy or low-energy methods. High-pressure homogenization, a staple, forces mixtures through narrow gaps at 500-2000 bar, shearing droplets to nanoscale. Ultrasonication uses sound waves for cavitation, while microfluidization employs impinging jets for uniform emulsions. Low-energy approaches, like phase inversion temperature (PIT), rely on surfactant phase transitions, ideal for heat-sensitive ingredients. Lab setups yield milliliters, but industrial processes demand tons. Continuous-flow systems, such as those using rotor-stator mixers, enable high-throughput, producing up to 1000 liters per hour. Key to success: Selecting surfactants like polysorbates, which reduce interfacial tension below 10 mN/m. Figures show that optimized formulations can achieve polydispersity indices under 0.2, ensuring monodispersity. This foundation sets the stage for amplification, where precision meets practicality.

The Scale-Up Saga: Bridging Lab Innovations to Industrial Realities

Scaling nanoemulsion production from lab to market involves replicating small-batch results on a grander scale, often multiplying volumes by 10,000-fold. Benchtop homogenizers give way to industrial units, but heat generation and shear forces can destabilize emulsions, leading to coalescence. A study on MF59-analog adjuvants demonstrated successful transition using microfluidization, maintaining droplet sizes below 150 nm across scales. Cost escalates: Energy consumption for high-pressure methods can reach 100 kWh per liter, demanding efficient cooling systems. Process analytical technology (PAT), including inline particle sizing, helps monitor quality. In food applications, the market for nanoemulsions is expected to hit $59.7 billion by 2028 at 11.86% CAGR, driven by scalable tech like ultrasonic processors. Success stories include vaccine adjuvants, where industrial rates exceed 500 kg/hour without compromising efficacy.

Nano Emulsion Challenges: Hurdles in Production and Stability

Nano emulsion challenges abound, particularly in maintaining stability during scale-up. Ostwald ripening, where smaller droplets dissolve into larger ones, can increase sizes by 50% over months if not countered with proper cosurfactants. Reproducibility issues arise from batch variations in raw materials, with pH fluctuations alone causing 20-30% deviation in zeta potential, a key stability metric. Equipment limitations, like pump cavitation in large homogenizers, hinder uniform energy distribution. Regulatory-linked challenges include proving long-term safety, as nanomaterials may exhibit novel toxicities. In pharmaceuticals, scaling polymeric nanoparticles—a related field—faces similar woes, with only 10-15% of lab formulations reaching clinical trials due to manufacturing inconsistencies. Economic barriers: Initial setup for cGMP-compliant facilities can cost $5-10 million. Addressing these requires robust design of experiments (DoE) to optimize parameters early.

Navigating the Regulatory Maze: Compliance and Safety Imperatives

Regulatory challenges for nanoemulsions stem from their nanoscale properties, which blur lines between drugs and devices. The FDA classifies them under existing frameworks but demands extensive characterization, including droplet size distribution via dynamic light scattering and toxicity profiles. In Europe, EMA requires REACH compliance for nanomaterials, assessing environmental impact. A key hurdle: Demonstrating equivalence between lab and scaled batches, with bioequivalence studies costing up to $1 million per product. For food uses, GRAS status is elusive without data on gastrointestinal fate, where nanoemulsions might enhance allergenicity. Figures reveal that only 20% of nanomedicines submitted since 2010 have gained approval, largely due to incomplete safety dossiers. Consumer acceptance lags, with surveys showing 40% concern over “nano” labels. Harmonizing global standards, like ISO/TS 19807, is vital for market entry.

Market Momentum: Facts, Figures, and Future Projections

The nanoemulsion market’s vigor is undeniable, with pharmaceuticals dominating at over 40% share, driven by oncology and anti-infectives. In 2022, the sector was worth $10.55 billion, forecasted to grow at 8.8% CAGR to 2029, fueled by rising chronic diseases. North America leads with 35% market hold, thanks to R&D investments exceeding $2 billion annually. Cosmetics and food segments follow, with nanoemulsions in skincare projected to reach $5 billion by 2028. Challenges notwithstanding, patents filed rose 15% yearly from 2013-2023, signaling innovation. Emerging markets in Asia-Pacific grow fastest at 9% CAGR, supported by manufacturing hubs. These stats underscore the economic incentive to overcome scale-up barriers.

Case Studies: Success Stories and Lessons Learned

Real-world triumphs highlight pathways forward. Novartis’s MF59 adjuvant, used in flu vaccines, scaled via high-shear mixing, producing millions of doses annually with droplet stability over two years. In cosmetics, L’Oréal’s nanoemulsion serums achieved market success by employing PIT methods, reducing energy costs by 30%. A food example: Aquanova’s NovaSOL technology encapsulates curcumin in nanoemulsions, boosting bioavailability 185-fold and scaling to industrial levels without regulatory snags in Europe. Lessons: Early regulatory consultation cuts approval time by 20%, and modular equipment eases transitions. Failures, like unstable ophthalmic formulations, teach the need for zeta potentials above 30 mV.

Looking Ahead: Innovations Overcoming Obstacles

Future innovations promise to ease nanoemulsion journeys. Advanced microfluidics enable precise control, reducing scale-up losses to under 5%. AI-driven modeling predicts stability, slashing development time. Green surfactants from plant sources address toxicity concerns, aligning with sustainable regulations. By 2030, the market could exceed $25 billion if challenges are met. Collaborative efforts, like FDA’s Nanotechnology Characterization Lab, standardize testing. Ultimately, from lab ingenuity to market dominance, nanoemulsions embody the thrill of scientific progress tempered by practical rigor.

Discover the future of wellness with NanoHempTechLabs‘ cutting-edge nanoemulsion products! Harnessing advanced nanoemulsion manufacturing, our wholesale lineup delivers superior bioavailability and stability for hemp-derived formulations, revolutionizing supplements, cosmetics, and beverages. From lab precision to market-ready scales, we overcome Nano Emulsion Challenges like stability and regulatory hurdles, ensuring top-tier quality. Backed by a booming market projected to reach $23.6 billion by 2033, our products enhance absorption up to 1000-fold. Elevate your brand with innovative, compliant solutions. Schedule a call today to explore wholesale opportunities and unlock exclusive partnerships!

Reference:

- Ali, G., Hambali, E., & Fahma, F. (2022). Potential of nanoemulsion process and method using agro-industrial based materials in skincare formulations: a review. Iop Conference Series Earth and Environmental Science, 1034(1), 012029. https://doi.org/10.1088/1755-1315/1034/1/012029

- Ashaolu, T. (2021). Nanoemulsions for health, food, and cosmetics: a review. Environmental Chemistry Letters, 19(4), 3381-3395. https://doi.org/10.1007/s10311-021-01216-9

- Das, A., Reddy, G., Newaj, S., Patel, S., Vichare, R., Liu, L., … & Janjic, J. (2025). Design of experiments leads to scalable analgesic near-infrared fluorescent coconut nanoemulsions. Pharmaceutics, 17(8), 1010. https://doi.org/10.3390/pharmaceutics17081010