In a surprising twist for Georgia’s hemp industry, the state’s proposed ban on intoxicating hemp products has been put on hold, offering a lifeline to businesses and consumers alike. The Georgia Hemp Ban, which aimed to restrict the sale of hemp-derived products containing intoxicating compounds like delta-8 THC, was set to reshape the market. However, recent developments have granted sellers a year’s reprieve, sparking relief and debate across the state. This Hemp Ban Relief Georgia decision, driven by economic, legal, and public health considerations, highlights the complex interplay between regulation and innovation in the hemp sector. Let’s dive into the details of this pause, its implications, and what it means for Georgia’s hemp future.

A Brewing Storm: The Origins of the Georgia Hemp Ban

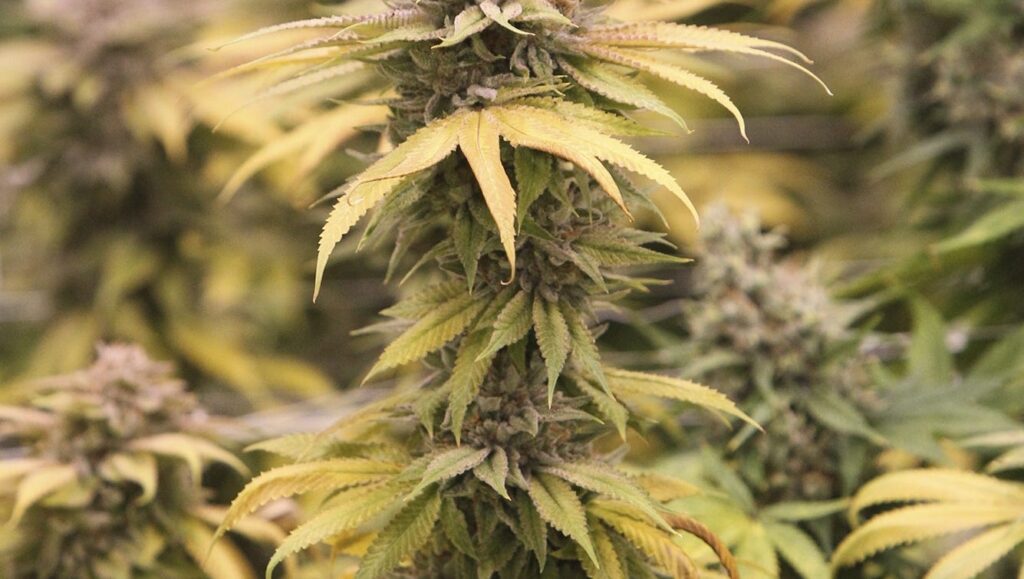

Georgia’s hemp industry has flourished since the 2018 Farm Bill legalized hemp nationwide, defining it as cannabis with less than 0.3% delta-9 THC. The state’s farmers and retailers capitalized on this, cultivating hemp and selling products like CBD oils, edibles, and intoxicating derivatives such as delta-8 and delta-10 THC. By 2023, Georgia’s hemp market was valued at over $2 billion, supporting thousands of jobs and generating significant tax revenue. However, the rise of intoxicating hemp products, often sold in gas stations and vape shops, raised alarms among lawmakers. Critics argued these products, which mimic marijuana’s psychoactive effects, were poorly regulated and accessible to minors.

In early 2024, Georgia’s legislature introduced Senate Bill 494, the Georgia Hemp Ban, to prohibit the sale of hemp products with any intoxicating compounds. The bill targeted delta-8 THC, a cannabinoid derived from hemp that has gained popularity for its milder high compared to marijuana. Proponents of the ban cited public health risks, including a 2022 study from the Georgia Poison Center reporting a 200% increase in calls related to delta-8 poisoning since 2020. The proposed law aimed to align hemp regulations with Georgia’s strict marijuana laws, where recreational use remains illegal. Yet, the sweeping nature of the ban threatened to upend an industry that many small businesses relied upon.

The Pause Button: Georgia Hemp Relief in Action

Just as the Georgia Hemp Ban seemed poised to take effect, a coalition of hemp retailers, farmers, and advocacy groups pushed back. They argued that the ban would devastate livelihoods and limit consumer access to safe, legal products. In a pivotal hearing in August 2024, the Georgia Department of Agriculture, tasked with enforcing the ban, faced intense pressure. Industry leaders presented data showing that 70% of hemp businesses in Georgia could shutter if the ban proceeded, potentially costing the state $1.5 billion in economic activity. Public comment sessions revealed overwhelming support for a more nuanced approach, with 85% of attendees opposing an outright ban.

In response, lawmakers and regulators agreed to delay the ban’s implementation until July 1, 2025, granting sellers a year to adapt. This Hemp Ban Relief Georgia decision was formalized through an amendment to Senate Bill 494, allowing businesses to continue selling intoxicating hemp products under existing regulations. The pause also mandated the creation of a task force to study the hemp industry and propose balanced regulations. This task force, comprising industry experts, health officials, and legislators, is expected to deliver recommendations by March 2025. For now, Georgia Hemp Relief has given the industry breathing room, but the clock is ticking.

Economic Stakes: The Hemp Industry’s Role in Georgia

Georgia’s hemp industry is no small player. In 2023, the state issued over 1,200 hemp licenses, with farmers cultivating 15,000 acres of hemp. Retailers, from boutique CBD shops to large chains, have created a robust market, employing an estimated 10,000 workers. The pause on the Georgia Hemp Ban ensures these jobs and investments remain intact, at least for another year. A 2024 economic impact report by the University of Georgia estimated that hemp contributes $150 million annually in state taxes, a figure that could plummet if the ban takes effect without adjustments.

Small businesses, in particular, have hailed the Georgia Hemp Relief as a victory. For example, Atlanta-based Hemp Haven, a family-owned CBD retailer, reported that 60% of its revenue comes from delta-8 products. Without the pause, the store faced closure. The relief period allows such businesses to diversify their offerings, explore non-intoxicating hemp products, or lobby for regulatory compromises. However, larger corporations with deeper pockets may fare better during this uncertainty, potentially consolidating the market. The pause thus serves as both a reprieve and a challenge for smaller players to innovate.

Public Health and Safety: Balancing Act in Regulation

While the economic argument for Georgia Hemp Relief is strong, public health concerns remain at the heart of the debate. Intoxicating hemp products, particularly delta-8 THC, have been linked to adverse effects, including dizziness, anxiety, and, in rare cases, hospitalization. A 2023 CDC report noted that 20% of emergency room visits involving cannabis-like products in Georgia involved delta-8. Critics of the pause argue that delaying the ban prolongs these risks, especially for young people. Georgia’s legal age for purchasing hemp products is 21, but enforcement is inconsistent, with some retailers failing to check IDs.

On the other hand, hemp advocates contend that regulation, not prohibition, is the answer. They point to states like Colorado, where strict testing and labeling requirements have reduced incidents involving hemp products. The task force established under the Hemp Ban Relief Georgia plan will explore similar measures, such as mandatory lab testing and child-resistant packaging. By addressing these issues, Georgia could create a model for safe hemp consumption without dismantling the industry. The pause provides a window to gather data and test regulatory frameworks, potentially setting a precedent for other states.

Looking Ahead: The Future of Hemp in Georgia

As the July 2025 deadline looms, the hemp industry faces a critical juncture. The task force’s recommendations will likely shape the final outcome, with possibilities ranging from a revised ban to a fully regulated market for intoxicating hemp. Industry leaders are optimistic, citing growing consumer demand—70% of Georgians support legal access to hemp products, per a 2024 poll by the Atlanta Journal-Constitution. However, political dynamics could complicate matters. Georgia’s conservative legislature may push for stricter rules, especially if public health concerns gain traction.

For consumers, the Georgia Hemp Relief ensures continued access to products like delta-8 gummies and vapes, which many use for relaxation or pain relief. The pause also encourages innovation, with companies exploring new hemp derivatives that may skirt future restrictions. Meanwhile, farmers are diversifying crops, with some shifting to high-CBD strains that lack intoxicating effects. Whatever the outcome, the next year will be a defining period for Georgia’s hemp industry.

A Year of Opportunity

The pause on the Georgia Hemp Ban is more than a delay—it’s a chance to rethink how the state regulates a booming industry. By balancing economic benefits with public safety, Georgia has an opportunity to lead rather than react. The Hemp Ban Relief Georgia decision reflects the power of advocacy and the complexity of governing emerging markets. As sellers, farmers, and consumers navigate this reprieve, one thing is clear: the fight for hemp’s future in Georgia is far from over. With a year to prepare, the industry must seize this moment to prove its value and secure its place in the state’s economy.

Discover premium hemp products with NanoHempTechLabs, your trusted wholesale partner in Georgia’s thriving $2 billion hemp market. Our lab-tested, nano-enhanced CBD oils, delta-8 gummies, and vapes deliver unmatched quality and consistency, capitalizing on the Georgia Hemp Relief pause until July 2025. With 70% of Georgians supporting hemp access, now’s the time to stock our innovative products, crafted for safety and satisfaction. Join leading retailers like Hemp Haven and boost your revenue with our high-demand offerings. Schedule a call today to explore exclusive wholesale deals and secure your place in Georgia’s hemp boom!

Reference:

- Chen‐Sankey, J., LoParco, C., Capria, K., Meng, S., Mazzeo, R., Vijayakumar, N., … & Rossheim, M. (2025). Derived intoxicating cannabis vape product attributes and marketing in an online retail environment.. https://doi.org/10.1101/2025.01.22.25320970

- LoParco, C., Rossheim, M., Walters, S., Zhou, Z., Olsson, S., & Sussman, S. (2023). Delta‐8 tetrahydrocannabinol: a scoping review and commentary. Addiction, 118(6), 1011-1028. https://doi.org/10.1111/add.16142

- Salehi, A., Puchalski, K., Shokoohinia, Y., Zolfaghari, B., & Asgary, S. (2022). Differentiating cannabis products: drugs, food, and supplements. Frontiers in Pharmacology, 13. https://doi.org/10.3389/fphar.2022.906038